We know you don’t understand tax and we love it.

So it makes sense that we’re a match made in heaven. We know that makes us a little weird.

The world of tax is full of acronyms, like TFN, ABN, FBT, CGT, SGC, TPAR & TBAR, to name a few. How’s that for confusing? We know how a TFN is used on an ITR, which can also record your CGT and we know to how to interpret this for you (in English).

What we do

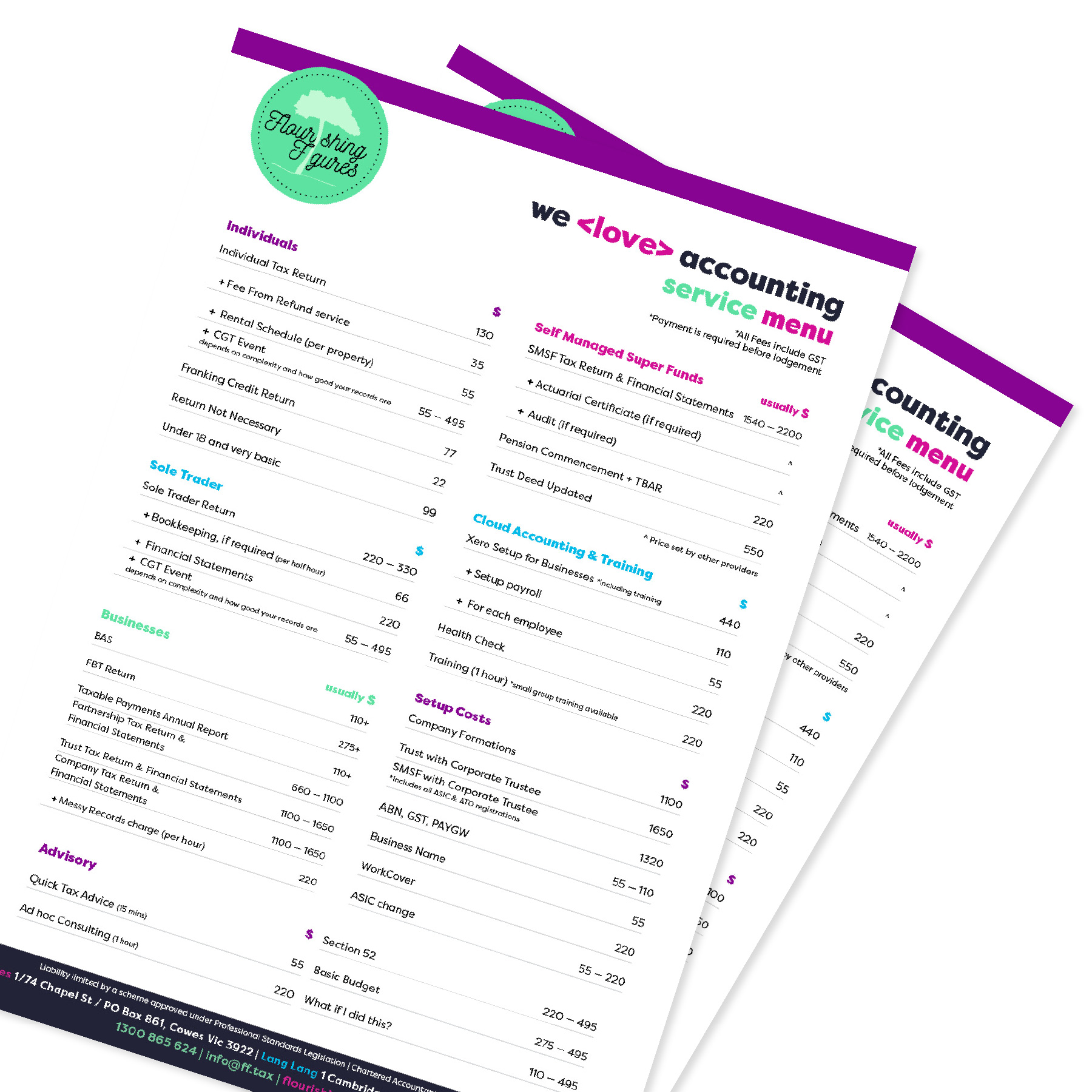

service menu

Individuals

| Individual Tax Return | 140 |

| + Fee From Refund service | 35 |

| + Rental Schedule (per property) | 70 |

| + CGT Event depends on complexity and how good your records are |

70 – 560 |

| Franking Credit Return | 77 |

| Return Not Necessary | 35 |

| Under 18 and very basic | 99 |

Sole Trader

| Sole Trader Return | 280 — 560 |

| + Bookkeeping, if required (per half hour) | 66 |

| + Financial Statements | 220 |

| + CGT Event depends on complexity and how good your records are |

70 — 560 |

Businesses

| BAS | 140+ |

| FBT Return | 330+ |

| Taxable Payments Annual Report | 140+ |

| Partnership Tax Return & Financial Statements | 880 — 1320 |

| Trust Tax Return & Financial Statements | 1320 — 1650 |

| Company Tax Return & Financial Statements | 1320 — 1650 |

| + Messy Records charge (per hour) | 280 |

Self Managed Super Funds

| SMSF Tax Return & Financial Statements | 1540 — 2200 |

| + Actuarial Certificiate (if required) | ^ |

| + Audit (if required) | ^ |

| Pension Commencement + TBAR | 280 |

| Trust Deed Updated | 550 |

^ Price set by other providers

Cloud Accounting & Training

| Xero Setup for Businesses *including training | 560 |

| + Setup payroll | 140 |

| + For each employee | 70 |

| Health Check | 280 |

| Training (1 hour) *small group training available | 280 |

Setup Costs

| Company Formations | 1210 |

| Trust with Corporate Trustee | 1760 |

| SMSF with Corporate Trustee *Includes all ASIC & ATO registrations |

1320 |

| ABN, GST, PAYGW | 70 — 140 |

| Business Name | 70 |

| WorkCover | 220 |

| ASIC change | 70 — 280 |

Advisory

| Quick Tax Advice (15 mins) | 83 |

| Ad hoc Consulting (1 hour) | 330 |

| Section 52 | 280 — 560 |

| Basic Budget | 280 — 560 |

| What if I did this? | 140 — 560 |

what do I need

to bring to my tax appointment

I can't make it

in person to complete my Individual Tax Return